Are you ready to unlock the secret power of social media for financial services in 2026?

Discover key strategies, best practices, and real-world examples to help financial service organizations harness the power of social media in 2026. Stay ahead of industry trends and compliance while driving growth—read the full guide now!

LEARN MORE LAUNCH DEMO NOW Social media is revolutionizing the way financial services connect with clients, drive engagement, and build trust—especially as we head into 2026. With Gen Z turning to platforms like TikTok, LinkedIn, and YouTube for financial advice and research, your brand's online presence has never mattered more. But leveraging social media effectively in this highly regulated industry means mastering compliance, security, and the art of authentic connection.

In this comprehensive guide, you'll discover practical strategies for financial service organizations to maximize their social impact. From choosing the right platforms and creating compelling educational content to building bulletproof compliance workflows and learning from top-performing campaigns, this post covers it all. Real-world benchmarks and actionable tips will help you engage both new and existing clients—so you can stay ahead of the competition and unlock growth in 2026 and beyond.

In this comprehensive guide, you'll discover practical strategies for financial service organizations to maximize their social impact. From choosing the right platforms and creating compelling educational content to building bulletproof compliance workflows and learning from top-performing campaigns, this post covers it all. Real-world benchmarks and actionable tips will help you engage both new and existing clients—so you can stay ahead of the competition and unlock growth in 2026 and beyond.

Table of Contents

- How can financial services benefit from social media?

- Why do social platforms matter for financial brands?

- Which platforms fit unique financial services audiences best?

- What key compliance rules shape your social strategy?

- How can financial brands build trust through connection?

- What are the latest content trends in financial marketing?

- How can teams use data to improve social success?

- What are inspiring examples of successful campaign strategies?

- Are you ready to take your financial business social?

How can financial services benefit from social media?

Financial services can benefit from social media in multiple ways, shaping how they connect with clients and grow their business. Social platforms offer an unparalleled opportunity for financial organizations to reach new audiences, including digitally savvy generations like Gen Z. By sharing educational content, thought leadership, and timely updates, financial brands can build trust and credibility while guiding customers through the complex world of finance. Social media also provides a cost-effective channel for lead generation, customer service, and staying ahead of industry trends through advanced social listening tools.

Moreover, social media humanizes financial brands by showcasing their values and highlighting the people behind the services. Consistent engagement on platforms such as LinkedIn, TikTok, and YouTube allows financial firms to emphasize transparency and establish authentic relationships with clients. By utilizing social media for both marketing and customer support, financial services can reduce operational costs, enhance client satisfaction, and differentiate themselves in a competitive marketplace. The strategic use of analytics further empowers teams to refine their content and ensure compliance, ultimately driving measurable business results.

Moreover, social media humanizes financial brands by showcasing their values and highlighting the people behind the services. Consistent engagement on platforms such as LinkedIn, TikTok, and YouTube allows financial firms to emphasize transparency and establish authentic relationships with clients. By utilizing social media for both marketing and customer support, financial services can reduce operational costs, enhance client satisfaction, and differentiate themselves in a competitive marketplace. The strategic use of analytics further empowers teams to refine their content and ensure compliance, ultimately driving measurable business results.

Why do social platforms matter for financial brands?

Social platforms are essential for financial brands because they connect financial institutions with audiences in real time, building trust and engagement. Social media allows brands to educate consumers, showcase expertise, and share thought leadership through channels like LinkedIn, X, and TikTok. By staying active and responsive online, financial brands can humanize their services, foster relationships, and drive business growth. In today’s digital world, leveraging social media is key to staying competitive in the financial services industry.

Which platforms fit unique financial services audiences best?

Selecting the best social media platform for financial services in 2026 depends on your target audience and content goals. LinkedIn excels for B2B and executive engagement, while TikTok and Instagram are ideal for reaching younger, mobile-first customers seeking quick financial tips. YouTube remains the go-to for long-form educational content, and X (formerly Twitter) is perfect for sharing real-time news and insights. By matching each platform’s strengths with your unique audience, your financial brand can maximize reach, engagement, and ROI.

What key compliance rules shape your social strategy?

Compliance is at the heart of every successful social media strategy in financial services. Key regulations like FINRA, SEC, GDPR, and FCA require firms to have clear approval processes and content archiving for all communications. Regular audits and up-to-date social media policies help teams stay ahead of evolving compliance standards. Protecting customer data, maintaining transparency, and keeping thorough records are essential to minimize legal risk and build trust online.

How can financial brands build trust through connection?

Financial brands can build trust through genuine connection on social media by sharing transparent stories, responding quickly to customer questions, and highlighting company values. Engaging with audiences in real time demonstrates accountability and creates a sense of reliability. Featuring leaders and experts in content helps humanize the brand, making it feel more approachable. Consistently delivering clear, helpful information on platforms like LinkedIn and Instagram fosters long-term relationships and trust.

What are the latest content trends in financial marketing?

Staying ahead in financial marketing means paying close attention to the latest content trends on social media. In 2026, financial services are embracing educational content, bite-sized video formats, and authentic storytelling to connect with their audiences. Platforms like TikTok, LinkedIn, and YouTube are seeing a surge in finance-focused content, especially from brands and executive thought leaders who want to break down complex topics in simple, relatable ways. Short, informative videos, live Q&As, and interactive posts are driving higher engagement and helping brands build trust with their communities.

Another key trend is the focus on compliance and transparency, as regulatory requirements tighten and audiences demand more from the brands they trust. Financial marketers are leveraging data-driven insights, customer success stories, and cause-driven campaigns to highlight their values and demonstrate real impact. By embracing content personalization, using automation tools, and fostering genuine conversations, forward-thinking financial brands are setting themselves apart and turning social media into a powerful tool for customer acquisition and retention.

Another key trend is the focus on compliance and transparency, as regulatory requirements tighten and audiences demand more from the brands they trust. Financial marketers are leveraging data-driven insights, customer success stories, and cause-driven campaigns to highlight their values and demonstrate real impact. By embracing content personalization, using automation tools, and fostering genuine conversations, forward-thinking financial brands are setting themselves apart and turning social media into a powerful tool for customer acquisition and retention.

How can teams use data to improve social success?

Financial services teams can harness data analytics to boost their social media success. By tracking key metrics like engagement rates, follower growth, and content performance, teams gain actionable insights into what resonates with their audience. This data-driven approach enables continuous optimization of strategy—ensuring every post delivers maximum impact. Ultimately, informed decisions powered by analytics can drive better results and set your financial brand apart in a competitive landscape.

What are inspiring examples of successful campaign strategies?

Some of the most inspiring examples of successful social media campaign strategies in financial services come from brands like Current, BNY Mellon, and Vanguard Group. These companies have embraced education-focused content, influencer partnerships, and consistent video series to build engagement and brand trust. For instance, Current’s influencer collaboration achieved a dramatic spike in app activity, while BNY Mellon used storytelling to showcase positive client impact. Vanguard’s regular social video series kept audiences engaged and returning for more expert advice.

Are you ready to take your financial business social?

Are you ready to take your financial business social?

Embracing a strong social media strategy is no longer optional for financial services in 2026—it’s essential. The right approach lets you reach new clients, humanize your brand, and share your expertise in a way that builds trust and credibility. By leveraging proven platforms like LinkedIn, TikTok, and YouTube, you can engage prospective clients where they’re already looking for advice and insights. Staying compliant and using the right tools will empower your team to post with confidence and track results effectively.

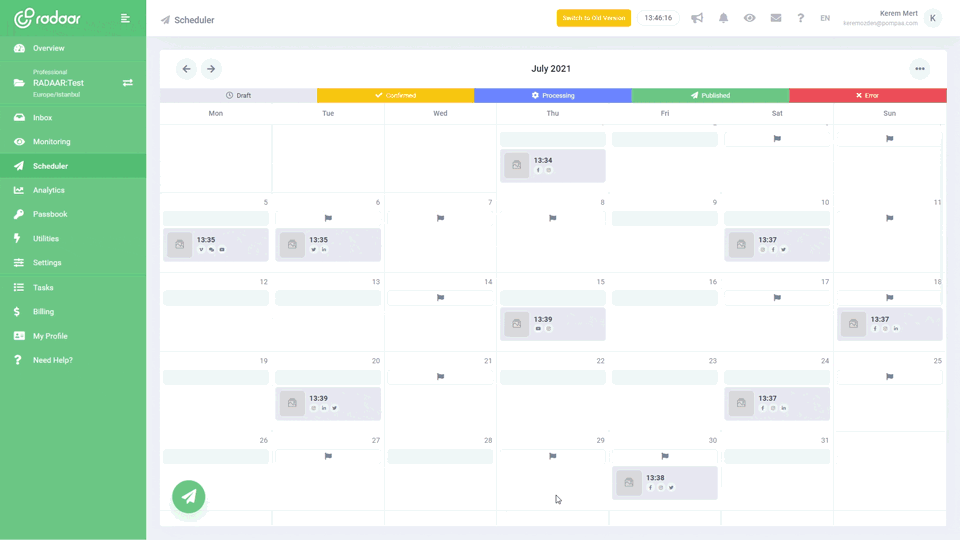

With so many moving parts, having a robust social media management solution is crucial. A platform like RADAAR can help simplify approvals, ensure compliance, schedule content, monitor trends, and analyze performance in real time. This means you can focus on what matters most—educating your audience and building meaningful relationships that drive business growth. Now is the perfect time to take your financial services business social—seize the opportunity and unlock the next level of success!

Embracing a strong social media strategy is no longer optional for financial services in 2026—it’s essential. The right approach lets you reach new clients, humanize your brand, and share your expertise in a way that builds trust and credibility. By leveraging proven platforms like LinkedIn, TikTok, and YouTube, you can engage prospective clients where they’re already looking for advice and insights. Staying compliant and using the right tools will empower your team to post with confidence and track results effectively.

With so many moving parts, having a robust social media management solution is crucial. A platform like RADAAR can help simplify approvals, ensure compliance, schedule content, monitor trends, and analyze performance in real time. This means you can focus on what matters most—educating your audience and building meaningful relationships that drive business growth. Now is the perfect time to take your financial services business social—seize the opportunity and unlock the next level of success!

SOCIAL MEDIA SCHEDULER

Plan and publish...

Plan and publish your content for Facebook, Instagram, Twitter, and LinkedIn from one simple dashboard.

LEARN MORE FREQUENTLY ASKED QUESTIONS

Are you ready to unlock social?

Have questions about using social media for financial services in 2026? Find clear, expert answers to your most common FAQ right here.

RELATED BLOG POSTS

All the tips & tricks you'll need...

Get the fresh tips and tricks you'll need to ace social media marketing.